SaaStock Local Talks are interviews we carry out with people who live and breathe SaaS.

Over these virtual coffees, we’ll discuss everything SaaS related.

The first interview featured Maciej Wilczynski, CEO of ValueShips, to discuss what he knows best – SaaS pricing.

In your face question, why you’re so hyped by SaaS pricing? What is so unique there?

That’s very easy to answer. Pricing is one of the most important parts of a strategy for SaaS sales. Let’s assume you’re working in a production facility full of machines that operate at full speed. You have daily, weekly, monthly production targets, and every day you fight with repairs, production line blocks, and you always look for improvement opportunities.

Imagine you have this one machine that is easy to fix, but no one wants to touch it because there is no process control over it, and you use it from time to time. This machine only can give you 10-15% profitability improvement a month, but you consciously decide to check it once every two years because you don’t know how to operate it. You choose to tighten the screws in the devices you already know by heart and leave that one be.

This machine is a usual pricing situation in a SaaS company. We want to focus on acquisition or retention. We constantly blog about it, do growth hacks, retain customers for as long as possible, etc. Price Intelligently did this excellent blogpost research. They have checked the volume of blog posts depending on the acquisition, monetization, or retention. Surprise, surprise, monetization is the least mentioned. I didn’t believe it, so I’ve analyzed exactly 2,031,786 blog posts and social media mentions, categorized 305 top words into 12 categories. The same thing, pricing is almost last. Everyone is talking about business branding or management, or, of course, growth hacking…

However, when it comes to monetization, we don’t want to touch it even though it’s a critical business function. It’s an absurd situation.

Wait, so you’re saying SaaS businesses purposely leave pricing behind?

Kind of yes. It’s this hot potato no one wants to hold. It’s the only marketing function that drives revenue. Advertising – customer acquisition cost. Product – development costs. Distribution – upkeep and customer success cost. Price – straightforward income. According to hundreds of conversations we have at Valueships with SaaS founders and CxOs, it’s about four things:

- We don’t want to screw things up, so let’s leave them as is – status quo effect

- We don’t have the capabilities to do it right and don’t know where to start (we need startup funding first)

- We think of the pricing as last and use rule-of-thumb to set the prices, and maybe we copy it from competitors

- We believe our pricing strategy is excellent – we’re generating revenue, growing at a triple-digit rate

In any case, pricing is an underutilized function.

OK, so let’s disaggregate it one by one. Status quo effect – what is it and why it’s important?

Naturally, it’s a common topic with any transformations and new implementations. That’s why we have “change management” as a learning course on every MBA program, and companies hire consultants. It’s pure psychology and reluctance to change. You’re cash flow positive; the MRR grows, you acquire new clients, your dollar retention is relatively strong, so why change? I understand the thinking.

However, if you look at any successful SaaS, ideally publicly traded automation companies. Which ones are the most profitable? Zoom, Atlassian, Dropbox, Wix and its AI website-building feature, SurveyMonkey, or many best SEO tools. They made many changes in their pricing policy as they grew. They were able to increase ACV by serving more personas and segments, including enterprise customers. That’s why they consecutively beat the Rule of 40% (Profit + Growth) and market median.

What about the capabilities, then? How can I start? One thing is not wanting to kill your SaaS engine, and the second is not knowing how to operate it.

Here, there are two questions: first, did you raise prices before? Second, did you raise prices for your current customers? If the answer is “no” or “long ago” to any of these questions, try thinking about your pricing capabilities.

You need to have the proper process in place. Run actual market research, ask for interviews, conduct value analysis and willingness-to-pay exercise, understand the value metric, packaging, and revenue model. It’s a start. Then it would help if you communicated it to the clients. You’ve probably developed two dozens of new features, so why you’re not charging more for it?

These are thousands of dollars you leave on the table because you’re not capturing the value generated by your product, and effectively you give it for free. If you’re not operating on the “pay-what-you-want” model (and I don’t know any successful SaaS operating like that), I don’t see the point of not raising prices.

I understand that you want to be thankful to your clients, especially the ones that were your early adopters. But they also grew, and in many cases, you’ve helped them to do so. It’s fair to ask for something back

SaaS businesses still grow because of the start-up VC-funded bubble, but they diminish if you look at the actual growth rate trajectory. Once the market commoditizes and the trend is clear, profitability will be more critical than ever.

If you beat $1M ARR or you’re close, you want to have a pricing manager who runs it on the intersection of product, marketing, finance, analytics. It’s OK if such a person also takes care of your research, customer insights & analytics process, so you have it all under one umbrella. This person is usually not aligned with any department, so it’s critical that reporting goes directly to the board and gets empowerment to work with other teams. Sorry, no silos possible here.

What about copying from others and, as you say: “rule-of-thumb” pricing? It’s a start-up world, so why should we even care?

Would you outsource your product development to your biggest competitor? I assume not. So why would you do this with your only revenue-generating marketing function? If you copy-paste others without any thought to it, you’re reacting to them; you’re passive. Pricing strategy should be as active as your growth efforts.

The previous product creation paradigm was simple. We have certain development costs; we apply reasonable overhead, understand the value created, and push it to the market. Now, with constantly decreasing willingness-to-pay and increasing CAC, we need to reverse it. Start from the value generated, understand how much the customer can pay, build the product around it and communicate it properly. Unfortunately, you can’t do it if you lick your finger, put it above your head, and check where the wind blows.

We have this whole pricing science for a reason, and we should learn from more established industries. If you want to get strong pricing knowledge, try learning from online banking, insurance, retail, and SaaS businesses, TelCo people. They understand the subscription business to their bones. I know everyone hated minute overheads by AT&T, but business-wise, it’s super intelligent. Btw. It’s now called usage-based pricing, so it always depends on how you name it.

Find a person responsible, establish a research process, figure out your transformation and implementation model. However, whatever you do rely on the data and customer insights – don’t be a fortune teller.

OK, last but not least, companies thinking their pricing is perfect. What about them?

They’re pretty good to work with because they at least consider their pricing strategy. You may say that pride comes before a fall, but it’s not that drastic in most circumstances. Usually, people are reasonable and rational. Proving a use case is hard, but that’s doable. We need the facts, so let’s look at them.

If a founder sees that their business is booming, attracting more and more customers who stick and don’t leave, it’s great. But, similarly to the legendary 5% monthly churn, there is a plateau of growth, which you need to fix.

For instance, ensuring a non-transparent pricing policy for enterprise clients is not the same as having your good-better-best pricing page. There is heavy discounting, sales reps commission, ensuring you have healthy unit economics and shorten the payback cycle. Once you grow, finances & accounting become more vital. It’s not only about management KPIs like LTV/CAC, but EBITDA and FCF come in handy. Do you have it available off-the-shelf? All of that belongs, at least partially, to the pricing function.

I understand now that I need to think of my pricing more carefully. So, where would you recommend starting?

Start reading and digesting through what is already available before you do anything.

Two content creators do it magnificently: Patrick Campbell from ProfitWell and Kyle Poyar from OpenView. If you read anything they’ve written, you’re in good hands. It’s pure gold. Even though I’m working with customer insights and pricing topics for years now, and for the most considerable Fortune 500 companies (as an ex-McKinsey & Company consultant), I still learn a lot from them. We publish our content at Valueships as well if you want to check.

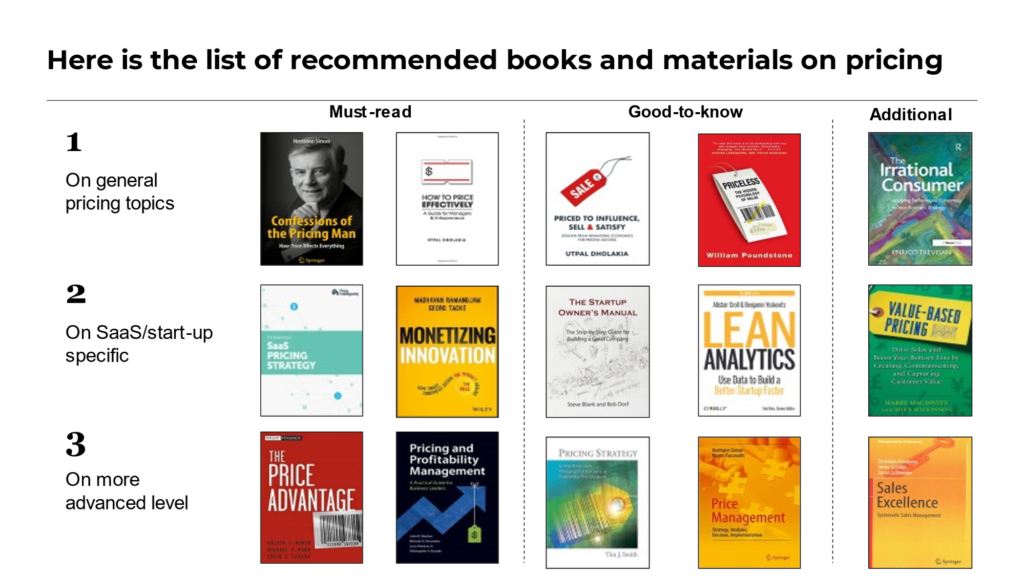

In terms of books on pricing, I recommend few authors: Herman Simon, a founding father of pricing as a science. His book “Confessions of the Pricing Man” is fantastic. Similarly, “Monetizing Innovation” was written by Madhavan Ramanujan. On top of that, Stephan Liozu has absolutely killer publications when it comes to value management. While there are not so many books on the market, few are outstanding. You should always keep an eye on your competitors’ and industry pricing, too – from very complex ones (e.g. Zoom) to simple examples (e.g. Sparkbay).

Thanks for discussing it with me.

Pleasure is all mine.