Finding the right investors and understanding what they want to see from founders and businesses is a struggle all too familiar for SaaS leaders.

SaaStock’s events, media, and growing SaaS community break down the barriers between founders and investors to facilitate new opportunities and make forging those relationships easier. We connect founders and investors through dedicated networking and share insights from global investors with our community.

All of this gives SaaS founders and executives a peek behind the curtain that uncovers:

- What investors are seeing in the market,

- How they identify investment opportunities,

- And how startups can stand out when they seek funding.

With SaaStock USA fast approaching, we searched the archives for key investor insights from our events last year and look forward to what you can expect from this year’s conference.

1. You need to unlock growth before you can scale

Speaking at SaaStock USA, Tae Hea Nahm, Co-Founder and Managing Director at Storm Ventures, described how companies can unlock high growth by finding what he calls “go-to-market (GTM) fit”.

In practice, a company with GTM fit has:

- Found urgency amongst it’s ICP,

- Nailed their go-to-market fit model,

- And built a repeatable go-to-market playbook to find and win customers over and over again.

It involves finding your champions and making them the hero of your GTM strategy. One thing to remember is that your champion might not be the decision maker but they will be the one to drive sales and usage going forward.

Watch the full session below:

2. Founder misconceptions about the funding process

Investors are approached by hundreds of companies. One way to make sure you reach the top of the list is to avoid common mistakes made by other founders.

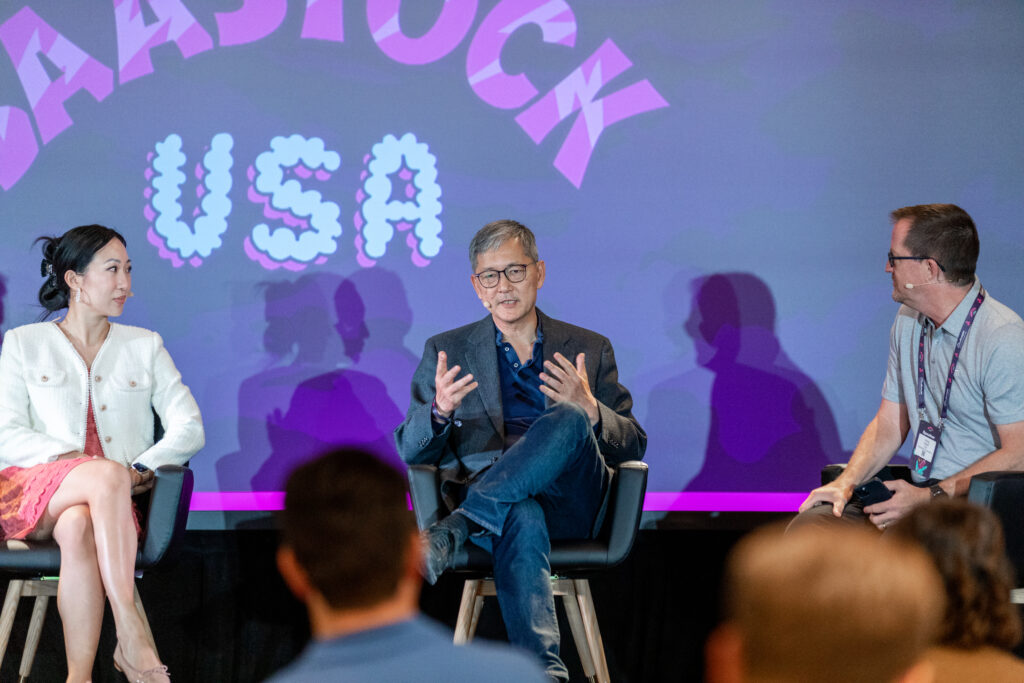

During a panel session on what matters to investors, Tae Hea Nahm (Co-Founder and Managing Director at Storm Ventures), Cathy Gao (Partner at Sapphire Ventures), and Miguel Fernandez Larrea (Co-Founder and CEO at Capchase) shared common misconceptions that founders have about the funding process and how to avoid them.

Misconception #1: You should fundraise when cash is running low

Capchase CEO Miguel Fernandez Larrea believes that startups should “always be fundraising”. Whether for equity funding, revenue based financing, or other forms of capital.

Instead though, many founders wait until they’re nearing the end of their runway before starting the process. He explained why this is detrimental and advised that founders look to raise six months before they run out of cash.

Leaving it beyond that point can impact your valuation, or result in a structured round, with more conditions in the agreement. For debt financing, it’s unlikely you’ll succeed at all because the risk is too high. Or as Miguel says, “it’s equity-like risk for debt-like returns”.

Misconception #2: Raising huge amounts of money proves your business’ worth

Sapphire’s Cathy Gao shared that many founders over-index the amount of capital they need to raise per round. She explained that while large sums and round figures look great on a press release, they are a measure of your fundraising capabilities, not how successful your business is.

Instead, she encourages founders to take a step back and think about what is required for your business to reach its milestones. That means, focusing on what you need to prove out your business model, and go-to-market strategy – rather than the nominal valuation or total amount raised.

Misconception #3: Assuming everyone in a VC firm thinks the same way

Finding the right investment at the right stage is crucial. Storm Ventures Co-Founder Tae Hea Nahm discussed how founders approach this by looking for the right firm.

While important, he explained that this approach assumes that everyone within a firm thinks the same way in terms of priorities and metrics.

This is a mistake that can trip founders up. Comparing himself to his Co-Founder – Tae Hea says that while both have over 20 years experience in early stage B2B software investment, how they approach it is actually very different.

He recommends that founders look beyond the firm to the individuals within it. Instead of asking whether a firm is right, ask whether an individual investor is philosophically the right fit.

3. Tell a story beyond the numbers

How founders can tell a story beyond the numbers is a common theme across investor sessions at our events. This is particularly important for Pre-Seed through Series B where there’s likely to be less historic data to work from.

Speaking at SaaStock Dublin, investors from Notion VC, Bessemer Venture Partners, PointNine Ventures, and Dawn Capital shed some light on how to do this successfully.

Firstly, make sure the data points you share add value to your narrative. Anant Vidur Puri, Partner at Bessemer Venture Partners, provided an example whereby an SMB software company said that it had only lost 1% of customers to date. While true, the company had been running for 18 months, had 3x growth over the last 12 months, and only sold up front annual plans – and so, in reality, less than 20% of customers had actually had a chance to churn.

Beyond the numbers, investors will be looking for a deep understanding of your ICP and how you can sell to them. This could initially be a smaller, more targeted segment but you’ll be expected to know how you can grow that audience. This might be growing vertically, going deeper into your niche or horizontally and expanding across borders.

Investor insights at SaaStock USA 2024

We’re bringing more investor insights to Austin in May with a jam packed content agenda, workshops, networking opportunities, and social events.

Hear from investors:

- How to execute a successful pivot to grow: Creating a new product category – Mary D’onofrio, Partner, Bessemer Venture Partners and Ev Konstevoy, CEO, Teleport.

- From $0 to a $3B valuation: Unconventional secrets behind Remote’s growth – Christine Esserman, Partner, Accel and Marcelo Lebre, Co-Founder, CEO and President, Remote.

- How to scale your technical SaaS startup beyond $50M ARR – Casber Wang, Partner, Sapphire Ventures and Kyle Hanslovan, Co-Founder and CEO, Huntress.

- Lessons from over $50B in exits: What makes a business worth more? – Thomas Smale, CEO, FE International.

- Building successful products in the AI era – SC Moatti, Managing Partner, Mighty Capital.

- A comedy of ARRs: How to approach fundraising in the profitability over growth era – Brandon Gleklen, Principal, Battery Ventures.

Network with investors:

From our dedicated networking area and the ability to book meetings ahead of time through our app to workshops, roundtables, and social events – SaaStock is full of opportunities for Pre-Seed to Series C founders to connect with investors.

We also offer founder and investor matchmaking and the chance for early stage startups to take part in in the global pitch competition, available through our Startup Program.

Join us in Austin, May 13-15

Join us and 1500+ SaaS founders, operators, and investors in Austin for all of this and more.

Tickets are selling fast – get yours now.

Read more about what’s on: